What Recent Consumer Foot Traffic to Chick-fil-A Says About Its Performance

July 6, 2023

Popular fast food chicken brand Chick-fil-A has solidified its position as a major player in the quick service restaurant (QSR) space. Chick-fil-A’s beloved year-round menu and seasonal offerings have become fast food staples, enabling whirlwind growth and widespread customer loyalty for the company. As the brand continues to expand, Chick-fil-A has been experimenting with new menu items such as the cauliflower sandwich and the maple pepper bacon sandwich. The company also decided to reintroduce its side salad that was previously removed from its menu this year. So, if Chick-fil-A is exploring new ways of attracting customers and expanding its reach, how are these changes affecting foot traffic to Chick-fil-A locations? Are these changes working to entice customers to visit Chick-fil-A restaurants?

To gain insight into Chick-fil-A’s performance, we examined foot traffic to Chick-fil-A locations nationwide along with some of the company’s major QSR competitors.

Consumer Foot Traffic to Chick-fil-A Locations

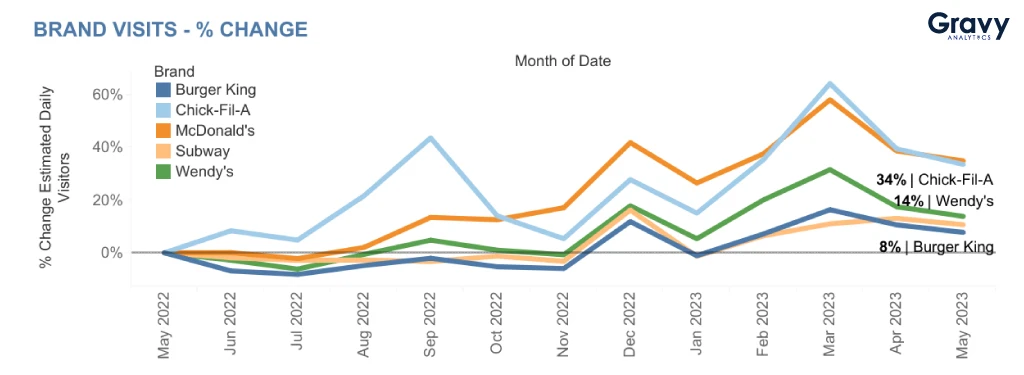

We analyzed foot traffic to Chick-fil-A alongside fast food competitors Burger King, McDonald’s, Subway, and Wendy’s to better understand Chick-fil-A’s performance in the fast food industry. From May 2022 to May 2023, Chick-fil-A experienced significant growth in year-over-year foot traffic with an increase of 34%. Similarly, McDonald’s saw significant growth in foot traffic, reaching a 35% increase year-over-year. Overall, the fast food restaurants we analyzed have been gaining foot traffic on an upward trend since the beginning of 2023, with every brand seeing notable growth.

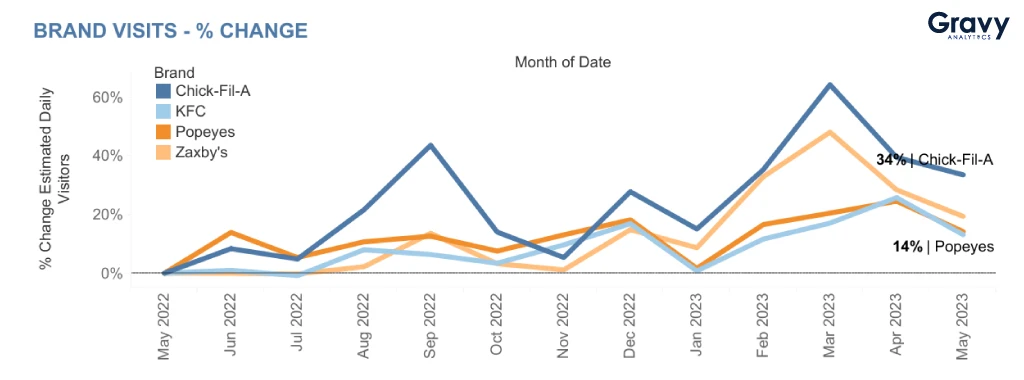

When comparing Chick-fil-A’s foot traffic data to competing fast food chicken chains, Chick-fil-A performed comparatively well. With its foot traffic increase of 34% year-over-year, Chick-fil-A boasted the greatest increase in foot traffic, while the second highest performer in this category was Zaxby’s with an increase of 19% year-over-year. However, all of the QSR chicken brands that we analyzed showed increased foot traffic since January 2023, in conjunction with the other QSR brands we analyzed.

The foot traffic trends we examined in the fast food category from May 2022 to May 2023 appear to mirror one another on an upward slope. All followed similar foot traffic trends over the last year, with spikes in foot traffic in December 2022 and again in March 2023. This suggests that dining at fast food restaurants increases during the holiday season and spring break. These similar trends may also suggest that there were additional shared factors impacting consumer foot traffic to fast food locations in general, particularly when considering the past year of elevated inflation and increased menu prices.

So, what factors may be contributing to the increased foot traffic to Chick-fil-A restaurants and competing locations?

Attracting Consumers in 2023

Recent consumer foot traffic trends suggest that consumers are going out to shop, find entertainment, and dine outside of the home more often. This also suggests increased discretionary spending as consumers lighten up their budgets to allow for more splurging. After years of grappling with post-pandemic economic disruptions, like inflation, that forced many consumers to budget and save heavily, it seems consumers are finding a renewed zest for fun outings and social activities. This is especially true as the summer months progress and people look for ways to spend their leisure time. We predict that many QSR brands will likely benefit from these shifting consumer trends.

Plus, Chick-fil-A isn’t the only fast food chain exploring new menu items and alterations in hopes of attracting consumers. Numerous QSR and fast-casual restaurant menus include recent new additions in hopes of continuing to attract customers in 2023’s highly competitive market. But, menus are not the only thing shifting with consumer interest. Consumers are beginning to expect more from their favorite QSR restaurants such as better customer service, faster service, and technologically-advanced ordering options. With consumers’ increasingly high expectations, it will be important for fast food chains to not only offer enticing menu items, but optimize their customers’ experience to keep them coming back in 2023.

Chick-fil-A and the Fast Food Space

All in all, Chick-fil-A continues as a key player in the QSR world, suggesting that the company understands its market and consistently meets customer expectations. In fact, Chick-fil-A was ranked as the leader in customer satisfaction last year, and according to Chick-fil-A’s increasing foot traffic, the company is still maintaining high levels of customer satisfaction. Furthermore, Chick-fil-A has an increasing appeal to younger generations, whose buying power and influence is immense and growing. Chick-fil-A’s connection with, and understanding of, its customers is helping the company build a strategic and future-proof business strategy.

Because of the brand’s success, Chick-fil-A’s international growth initiatives and menu changes could invite new levels of success—and increased foot traffic—well into 2024.

For more brand performance and consumer foot traffic insights like this, subscribe to our email newsletter today.`