Chick-fil-A’s Cauliflower Sandwich: What Foot Traffic Data Tells Us About Consumer Interest

March 30, 2023

Recently, consumers have been spending with convenience and affordability in mind, particularly when it comes to dining. As the data from our Q4 2022 Consumer Trends Report shows, consumers are largely choosing fast food locations over any other type of restaurant, likely due to the quick service and fair prices that fast food restaurants offer. But this doesn’t mean that top market leaders in fast food are seeing the most foot traffic. One leader in fast food, Chick-fil-A, saw the least year-over-year foot traffic in the fast food category. This may be due to its price increases as food costs soar, forcing menu price hikes up to 30%. However, as post-pandemic economic disruptions persist, consumer trends will continue to fluctuate, so could a new Chick-fil-A sandwich bring in-person visitors back?

Chick-fil-A recently launched a new product sparking internet buzz and curiosity among customers: a chickenless cauliflower sandwich. The new cauliflower sandwich was released in select test markets as a plant-forward outlier to the otherwise chicken-based QSR (quick service restaurant) menu. But how did consumers respond overall, and what can consumer foot traffic data help us learn about this new product launch?

To gauge consumer interest in the new Chick-fil-A sandwich, Gravy Analytics analyzed foot traffic data to Chick-fil-A restaurants in and out of the selected test markets.

Foot Traffic to Chick-fil-A Test Markets

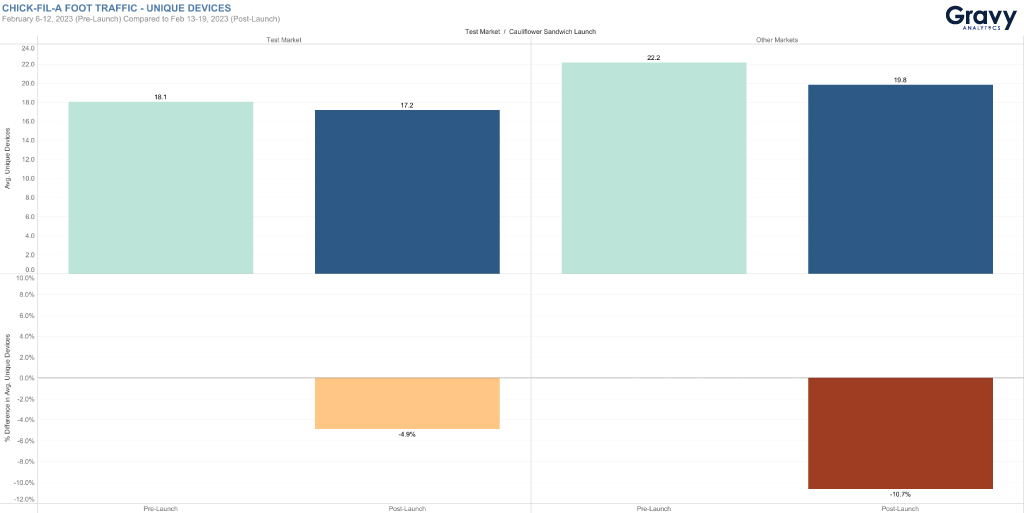

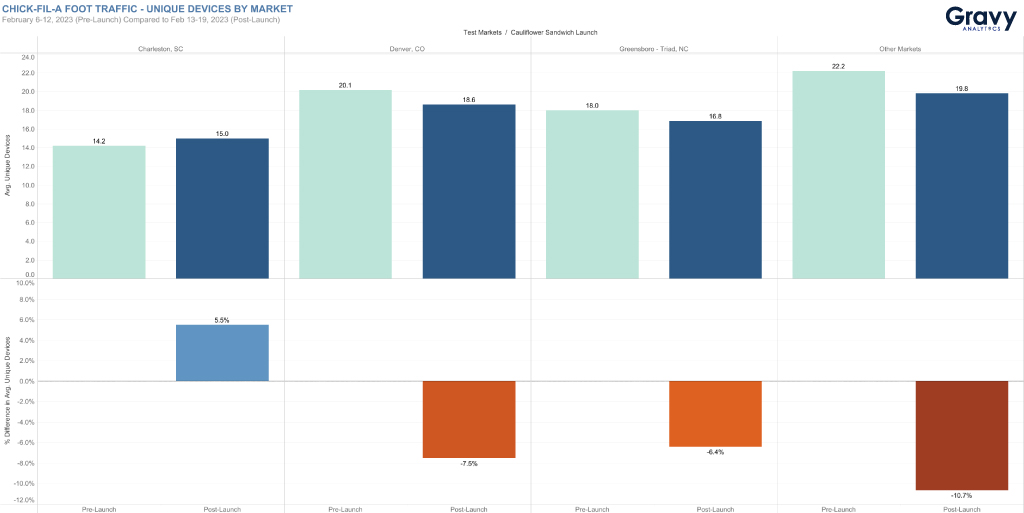

The new Chick-fil-A sandwich launched in three test markets on Feb. 13: Denver, CO, Charleston, SC, and Greensboro-Triad, NC. We analyzed foot traffic to these markets compared to all other markets between Feb. 6-12, 2023 (pre-launch) and Feb. 13-19, 2023 (post-launch).

During the week of the launch, foot traffic to Chick-fil-A locations decreased overall compared to the previous week. However, Chick-fil-A restaurants in the three test markets saw a smaller decline in foot traffic on average, compared to all other markets, suggesting that there was some consumer interest in the new Chick-fil-A sandwich. Compared to the week prior, the three test markets saw a decline of 4.9% in foot traffic. On the other hand, all other markets saw foot traffic decrease by 10.7% on average, more than doubling the decline seen in the test markets.

When looking at foot traffic data for each test market individually, one region experienced an increase in foot traffic during the week of the launch. Charleston, SC, saw an increase of 5.5% in foot traffic, while the other two test markets saw decreases. Because of the area’s diverse food culture and emphasis on tourism, perhaps there were more consumers open to trying the new Chick-fil-A sandwich in Charleston than in other markets. Greensboro-Triad, NC, and Denver, CO, experienced decreases of 6.4% and 7.5% in foot traffic, respectively.

So, why did foot traffic decrease on average to all Chick-fil-A locations during the week of the new product launch?

Chick-fil-A’s Week-to-Week Decline

Consumer foot traffic ebbs and flows greatly throughout a single year. Holidays, special promotions, world events, and more can impact consumers’ decisions on where they choose to go. In the case of Chick-fil-A, the new cauliflower sandwich launched during the week of Valentine’s Day, which may be why Chick-fil-A’s nationwide foot traffic declined for the week we analyzed.

Valentine’s Day is usually not a favorable day for foot traffic to fast food restaurants. During Valentine’s Day, consumers often celebrate by dining in couples or groups, spending up to $287 on average. Consumers are looking for international food, candlelit dinners, or fast casual sit-downs around Valentine’s Day. Furthermore, many consumers don’t even eat out, but instead choose to dine at home for the holiday. So, although Chick-fil-A celebrated Valentine’s Day with heart-shaped packaging to entice customers, foot traffic still fell overall for Chick-fil-A, and likely for other fast food chains as well.

The good thing is, although overall foot traffic to Chick-fil-A locations fell during the week of the cauliflower sandwich launch, compared to the week prior, foot traffic didn’t fall as much in test markets, suggesting that the new menu item has the potential to attract a new wave of customers to Chick-fil-A. However, foot traffic in the three test markets on average during the launch week did not surpass the levels seen before the sandwich’s debut, suggesting that initial consumer interest may not have been as strong as expected. But if consumers who tried the new cauliflower sandwich enjoyed it, Chick-fil-A may consider adding it to the menu nationwide. Would this then spark a surge of foot traffic to Chick-fil-A locations in 2023?

Will the New Chick-fil-A Sandwich Attract Visitors?

In-person visits are important because of the sensory experience a customer gets at a restaurant location, often encouraging them to become repeat visitors. So, real life experiences are the most effective way to acquire loyal, happy customers which is more cost-effective than acquiring new customers. The key to building a loyal customer base in the restaurant industry is appealing to what customers find to be the most important factors of their experience at a restaurant. Food quality, service quality, and restaurant atmosphere are some of the top reasons customers return to a restaurant location, and customers can only fully experience those things in person. This is why in-person visitors are important to any restaurant chain. Introducing a new menu item is one strategy that can bring more visitors in by offering them a new food experience and a more well-rounded menu.

Although there has been criticism about the price point of the new Chick-fil-A cauliflower sandwich, there could be strategic reasons for its higher-than-usual price. As menu prices rise in the QSR world, Chick-fil-A could still benefit from adding the new, relatively pricey sandwich to their menu. According to menu psychology, price anchoring by adding high-priced items can provide the illusion of higher value to the rest of the menu.

So, this potential, plant-forward menu addition could be a strong strategic move for Chick-fil-A. That is, if customers are willing to pay.

The Bottom Line

This new menu addition could provide various competitive advantages for Chick-fil-A, even through the economic disruptions consumers are grappling with right now. However, as more consumers look to stretch their dollars these days, the high price of the new sandwich may prove to be an obstacle. Plant-forward and vegetarian eating is growing in popularity, but current consumer trends point to affordability and necessity the most.

Adding more veggie-focused items to their menu could attract more consumers to Chick-fil-A, but it may not be the right time to launch a new sandwich at a $7 price point. So, even though a new addition could add some diversity and freshness to the Chick-fil-A menu, recent consumer trends and Chick-fil-A’s foot traffic data are showing that the company may have missed the mark with the cauliflower sandwich.

For more foot traffic insights and brand analyses like this, subscribe to the Gravy Analytics email newsletter.