5 Things Marketers Know Just By Looking at Foot Traffic Data

March 26, 2020

By Jolene Wiggins, Gravy Analytics CMO

As a digital marketer, I’m always measuring what works and what doesn’t: did my campaign reach the right people? Did they visit my business or ask to speak with sales? How is my new product launch going? What is my competition doing?

Derived from mobile location signals, location intelligence is an increasingly important trove of data and insights helping marketers answer these questions. But while there are many different types of analysis that can be done using mobile location data — from advertising attribution to site selection to brand loyalty — one of the most interesting is foot traffic analysis.

So, what exactly does foot traffic analysis tell us about a company, its customers, and their competition? Here are 5 things marketers can tell just by analyzing a company’s foot traffic data:

1. We Know When Your Business is Busy and When It Isn’t

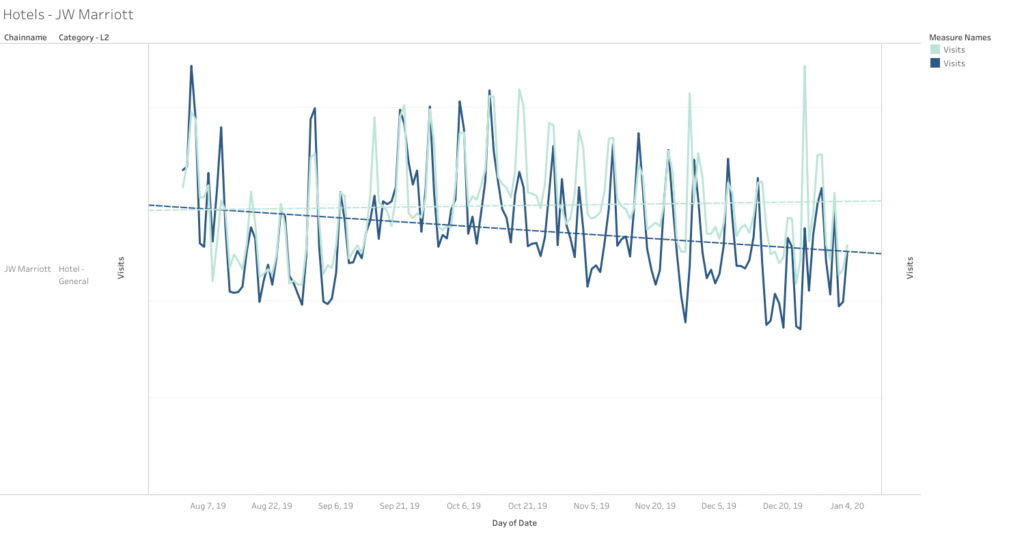

Many families take advantage of school breaks to go on vacation, so you might assume that hotels and resorts are at their busiest when school is out of session. However, foot traffic analysis shows that this is not always the case. Consider foot traffic at JW Marriott hotels during the 2019 holiday season: while overall foot traffic in the ”hotel” category increased slightly over the holidays, total foot traffic at JW Marriott properties actually reached its peak earlier in the year.

2. We Can Tell if Your Business is Differentiated – or Following a Crowd

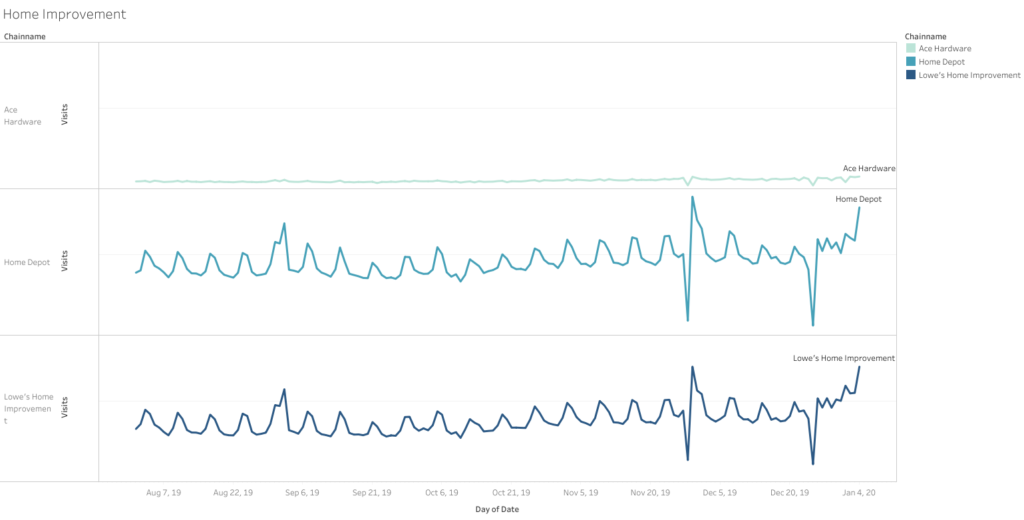

Top home improvement brands include Lowe’s, Home Depot, and Ace Hardware. While foot traffic patterns at Lowe’s and Home Depot are nearly identical— lower during the week and peaking on weekends — Ace Hardware sees more of its foot traffic during the week with only a slight increase on weekends. Whether through store location, product selection, or its customer service, Ace Hardware is running a very different business that brings home improvement buyers in on different days.

3. We Understand How Well Your Company is Performing Relative to Others in Your Market

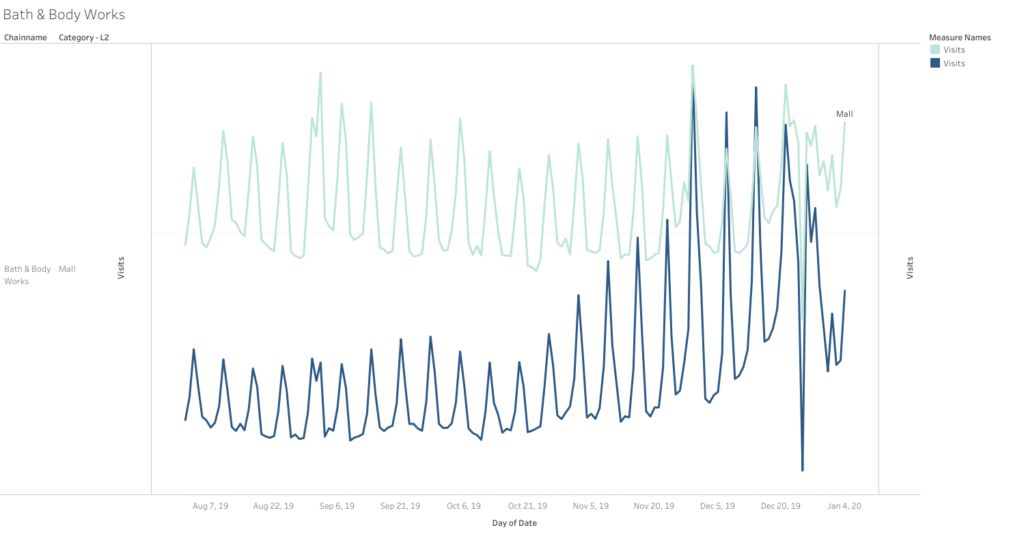

By comparing store foot traffic for a single brand to overall foot traffic for a particular category, marketers can get a pretty good idea of whether their brand is over-performing or under-performing compared to an area or industry as a whole. Consider mall staple Bath & Body Works compared to all Mall traffic:

Mall traffic peaks over the holidays (and during back-to-school shopping), but Bath & Body Works foot traffic is in an entirely different league during the holiday shopping season.

4. We Can Tell Which of Your Competitors are Gaining Traction

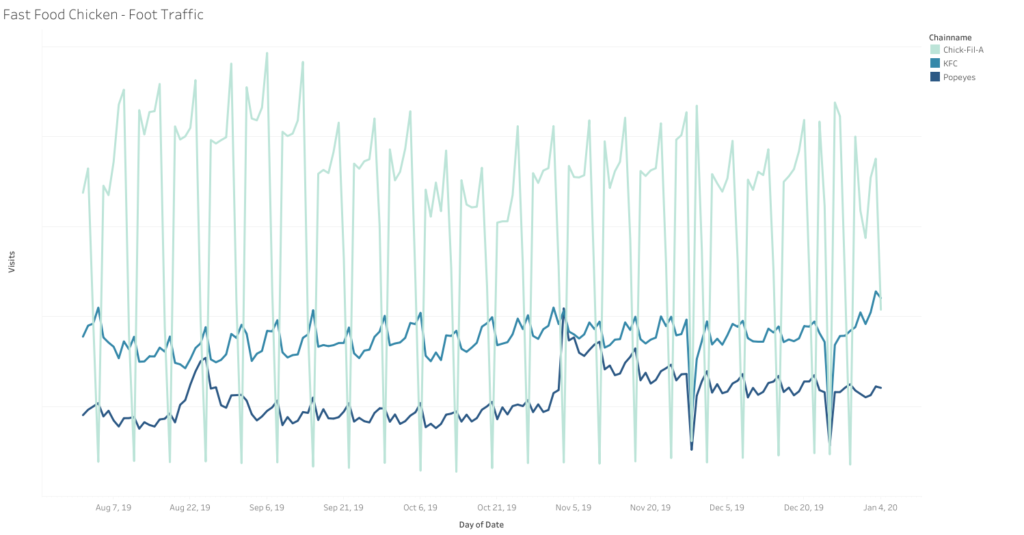

Competitors in a mature market often trade customers and foot traffic. When one company sees an increase in foot traffic, another company competing for the same customers receives less foot traffic. Popeyes’ spicy chicken sandwich, first introduced in August – and quickly removed from the menu when inventory could not keep pace with consumer demand – immediately shifted foot traffic from other fast food chicken competitors like KFC and Chick-Fil-A. After Popeyes reintroduced its sandwich in early November, Popeyes share of foot traffic increased once again, and remained higher through the end of 2019.

5. We Know if Your Latest Marketing Campaign was Successful

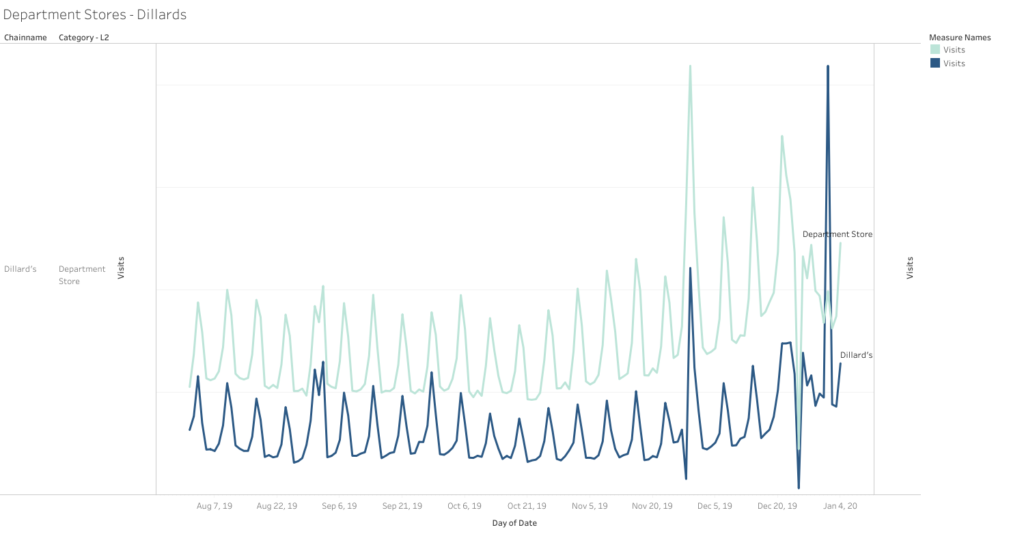

Pronounced changes in foot traffic patterns are often good indicators that a marketing program was successful. Consider the department store category, which sees its highest foot traffic of the year during the holiday shopping season. Looking at just one department store, Dillard’s, we see that foot traffic follows the same pattern – except for New Year’s Day. On New Year’s Day, Dillard’s saw even higher foot traffic than on Black Friday. Why did this happen? Dillard’s planned and promoted a New Year’s Day sale that clearly succeeded in bringing more customers to its stores. It probably helped that Dillard’s was one of just a few retailers promoting a New Year’s Day sale, making it easier to get shoppers’ attention.

Foot Traffic and Location Intelligence as Marketing Tools

These are just a few of our observations based on foot traffic data for more than 3.500 leading brands. Foot traffic insights can also be used to identify new market trends, inform new product or service ideas, and provide clues when additional research or troubleshooting is needed. Location intelligence and foot traffic analysis are valuable tools for any marketer wanting to better understand their industry, measure the success of various initiatives, and keep tabs on the competition.

What could you learn about your business – and your competitors – from foot traffic data? Speak with one of our location data experts to find out. Request your no-obligation consultation today.