Are U.S. Consumers Tired of Pizza?

November 29, 2022

Stocks, trends, and location intelligence all point to fading consumer interest in pizza. But, could there be an upswing for the nation’s top pizza chains?

The pizza pie was the first food ever delivered to a customer. This changed foot traffic patterns forever. In the age of COVID-19, delivery food became a must. Lobbies closed, and third-party delivery platforms flourished. Ordering a pizza became easier than ever, but so did ordering tacos, pasta, or almost any option consumers wanted. Because eateries are opening back up and consumers crave social interaction, what does this now mean for pizza, the pioneer in fast and delivery food?

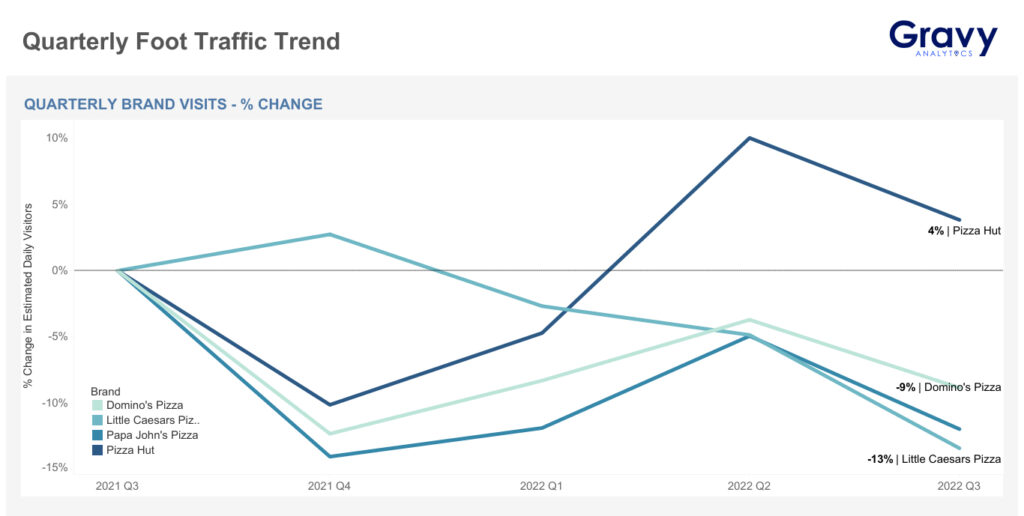

Domino’s, Little Caesars, Pizza Hut and Papa John’s are the top pizza chains in the nation. We analyzed foot traffic data for these pizza giants over the last year, and for the most part, they’ve been seeing similar patterns in foot traffic. They all saw a steady increase in foot traffic from Q4 2021 until Q2 of this year—except for Little Caesars.

Since 2021, Little Caesars has been a foot traffic outlier. They were the only one of the four companies to see an increase in foot traffic from Q3 to Q4 of 2021. While the competition was in the negatives, Little Caesars concluded Q4 last year with a 3% increase in foot traffic. Then, foot traffic to Little Caesars started to decline. In fact, for 2022, Little Caesars has been the only major pizza chain to experience a consistent downslope in foot traffic. As of Q3 2022, foot traffic had dropped by 13% year-over-year.

While Little Caesars had the most unusual foot traffic pattern over the last year, Pizza Hut boasted the biggest increase in foot traffic (likely due to their dine-in options). But, all four pizza chains have one thing in common: they all had declining numbers in the third quarter of 2022. This downturn could be the result of recent, post-pandemic consumer dining habits.

Are Consumers Sacrificing Pizza?

These big chains may be experiencing a post-pandemic slowdown as pizza fatigue sets in. More traveling and social gatherings may mean less habitual visits to common pizza chains. As entertainment and food options become increasingly available, people are visiting more diverse spots for dining while they shop, catch a movie, or grab a drink.

With the recent surge in social outings, demand for different dining options is growing. This means pizza’s competition is getting fierce, and particularly so from another common comfort food: the burger. With McDonald’s running creative campaigns (like the adult Happy Meal), they’re attracting a more cost-conscious, dine-in crowd. Burger King is also on the rise with a plan to accelerate their growth. As brands find new ways to compete with each other, foot traffic may begin to walk away from pizza—unless our pizza giants start to get creative.

Top Pizza Chains Have a New MVP

Although the pizza category has seen a recent drop in visitors, a boost could be right around the corner. Pizza stocks are dipping, but these big-name pizza brands could be in the perfect position to bounce back and see more foot traffic—and sales—soon. This bounce-back could come especially quickly for our foot traffic outlier: Little Caesars.

Little Caesars is the market leader in value pizza and the third largest pizza chain in the nation. Given that consumer habits are currently emphasizing value, this is the ideal time for Little Caesars to entice customers. These days, people are looking for the best deal, which they’ll likely find at Little Caesars.

Not only that, but Little Caesars secured a major win this year by becoming the newest NFL pizza sponsor. NFL football is the most popular sport to watch in the States, and nearly 40% of NFL fans prefer to eat pizza during game time. As football season rolls along, Little Caesars could have a growing number of visitors, especially as society gets more social and more thrifty. It will be interesting to see how this perfect storm of habits and events affects Little Caesars and other top pizza chains.

Ready to learn more about location intelligence? Connect with one of our experts today.