What Foot Traffic Data to Retailers and Department Stores Reveals About Current Consumer Trends

August 8, 2023

In 2023, shopping is back in full swing after a period of economic uncertainty following the pandemic. Initially, consumers grappled with soaring inflation, surging housing prices, and other economic disruptions, resulting in dwindling foot traffic to shopping centers, malls, and various retailers. However, as 2022 came to a close, foot traffic to many shopping destinations began to steadily rise once again. This year, foot traffic to those shopping destinations has continued to rise—particularly when it comes to malls, shopping centers, and department stores.

Amid this growth, we wondered what foot traffic to top retail brands and department stores looks like today and what we can learn from this data.

Foot Traffic to Top Retailers and Department Stores

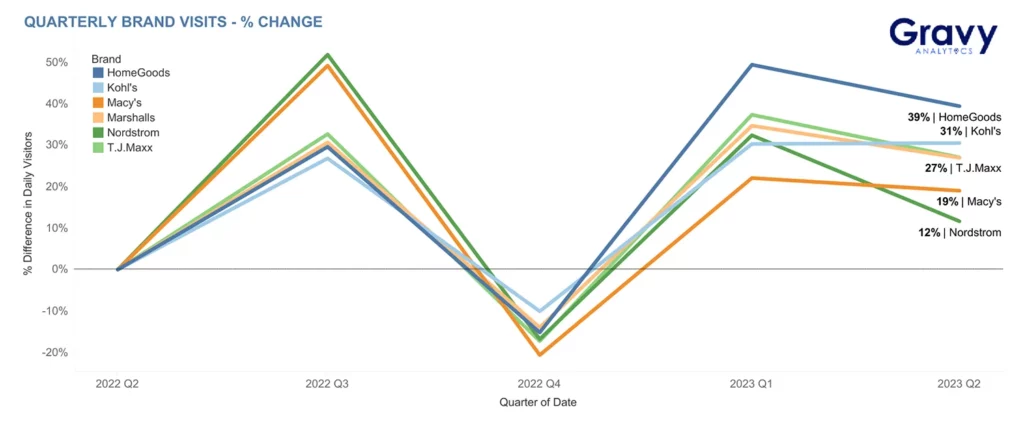

To learn more, we analyzed foot traffic to HomeGoods, Marshalls, and T.J. Maxx (all owned by parent company TJX), along with Kohl’s, Nordstrom, and Macy’s. We examined the data from Q2 2022 to Q2 2023, and we found that all companies experienced growth in year-over-year foot traffic.

In Q3 2022, all brands saw a spike in foot traffic; however, this was followed by a steep decline in Q4 2022. Although this was during the holiday season, when many consumers would likely be visiting stores to purchase gifts, it could be that some consumers simply purchased gifts online to avoid crowded stores, while others might have prioritized spending on essential goods like groceries in response to the prevailing high inflation during that time. However, after this decline in foot traffic, all companies made impressive recoveries in year-over-year foot traffic in the new year.

For the time period we analyzed, HomeGoods saw the most significant growth in foot traffic, with a remarkable 39% increase year-over-year. Kohl’s closely followed HomeGoods, seeing an increase of 31% in year-over-year foot traffic. While these two brands saw the most significant increases, Marshalls and T.J. Maxx saw notable increases of 27% as well. At the lower end, Macy’s and Nordstrom experienced increases of 19% and 12% year-over-year, respectively. While they didn’t experience the same substantial increases as HomeGoods or Kohl’s, it is notable that all companies experienced strong levels of foot traffic growth.

What factors might be influencing the foot traffic to retailers and department stores, and will this trend continue on?

Amid High Inflation, Foot Traffic Shifts Toward Affordable Brands

Our data shows that there has been a noticeable surge in foot traffic at affordable retailers, such as HomeGoods, T.J. Maxx, Marshalls, and Kohl’s, compared to their more upscale department store counterparts like Macy’s and Nordstrom. This trend can be attributed to the increasing interest among consumers in value shopping and the desire to save money. With higher inflation rates affecting overall living costs, many individuals are actively seeking ways to be more cost-conscious in their spending habits. As a result, the affordability and competitive pricing offered by these budget-friendly brands may have become particularly appealing.

The year-over-year foot traffic increases at these affordable retailers serve as a clear indication that consumers are prioritizing value and actively seeking ways to stretch their budgets. In contrast, department stores, which often feature higher-priced merchandise and luxury items, may be experiencing less foot traffic as consumers opt for more budget-friendly alternatives in the face of economic challenges. This shift in consumer behavior highlights the importance of catering to the changing preferences and financial constraints of shoppers in today’s uncertain economic landscape.

In-Person Shopping Regains Popularity Post-Pandemic

After the pandemic forced consumers indoors and left many commercial brick-and-mortar locations with declined foot traffic, consumers gained a renewed appreciation for in-person activities once COVID-19 restrictions were lifted. As they began to visit commercial locations more and more following the pandemic, in-person shopping became popular once again. In fact, consumers’ views and expectations of in-person retailers have largely expanded post-pandemic.

These days, many consumers prefer shopping in person rather than online for a few reasons. While online shopping has added convenience and ease to the shopping experience, consumers are still enticed by the convenience of receiving purchases instantly when shopping in person. Not only that, but consumers appreciate the ability to see, touch, and feel items before purchasing—another perk they don’t get when shopping online.

Perhaps one of the most impactful changes we’ve seen in shopping trends is the evolving attitude toward shopping. Consumers are now appreciating in-person shopping as a social experience rather than an errand, and many opt to shop in person for the enjoyment of doing so with family and friends. This is likely contributing to the surges in foot traffic to the retailers and department stores we analyzed. If consumer foot traffic to these store locations continues to increase, it will be interesting to see how and if these brands continue evolving to add to the social aspect of in-person shopping.

Pent-Up Demand Spurs Retail Foot Traffic Growth

The pandemic forced major shifts for consumers and businesses alike. In 2020, foot traffic to many commercial areas lessened, and many consumer and brand interactions happened digitally. While consumers were avoiding public areas and largely staying at home due to pandemic concerns and restrictions, pent-up consumer demand was on the rise. For various industries like the automotive and travel industries, pent-up demand has driven surges of foot traffic to commercial locations of interest, and this is the case for retail locations and department stores as well.

For instance, consumer purchase data showed that in 2021, pent-up demand for department stores began to increase, with sales jumping over 200%. Consumer foot traffic data shows that this demand continues, and the enjoyment of the shopping experience lives on well after the pandemic has come to a close.

For more real-world consumer behavior insights like these, subscribe to our newsletter today.