Adapting Your Travel Advertising Strategy with Gravy Audiences

September 22, 2020

Most gyms in the U.S. have welcomed their members back. But, are gym members going back to their old routines? In a survey by TD Ameritrade, 59% of respondents said that they plan on canceling their gym memberships. Instead of going to the gym, many Americans are working out at home or outside. How much is this new consumer trend changing foot traffic patterns at gyms? To find out, we analyzed consumer foot traffic at four leading fitness brands to determine how COVID-19 is impacting gym attendance.

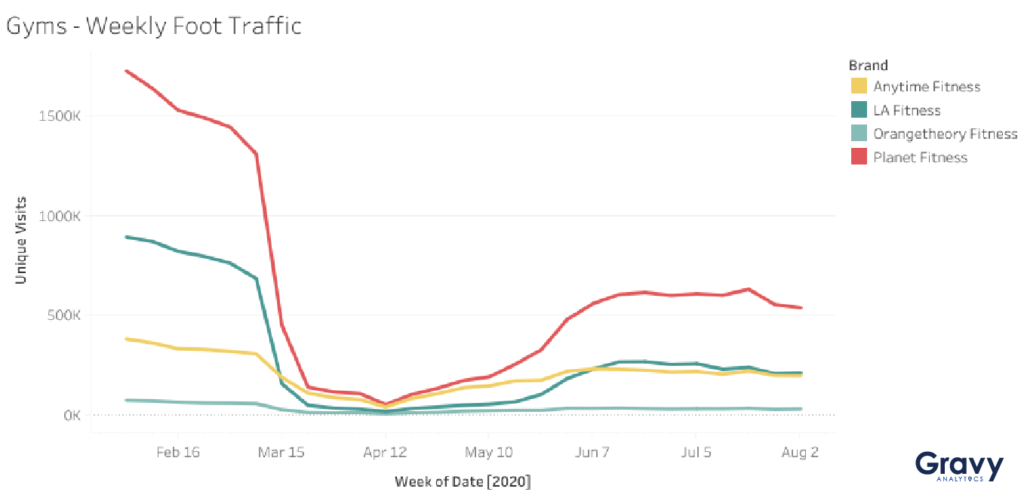

An Overview of Foot Traffic at Four Major Gyms

Foot traffic to Anytime Fitness, LA Fitness, Orangetheory Fitness and Planet Fitness declined drastically in mid-March and reached its lowest point in mid-April. Foot traffic slowly began to recover at all four brands starting in mid-May as more gyms began to re-open. By June, foot traffic for all brands began to level off.

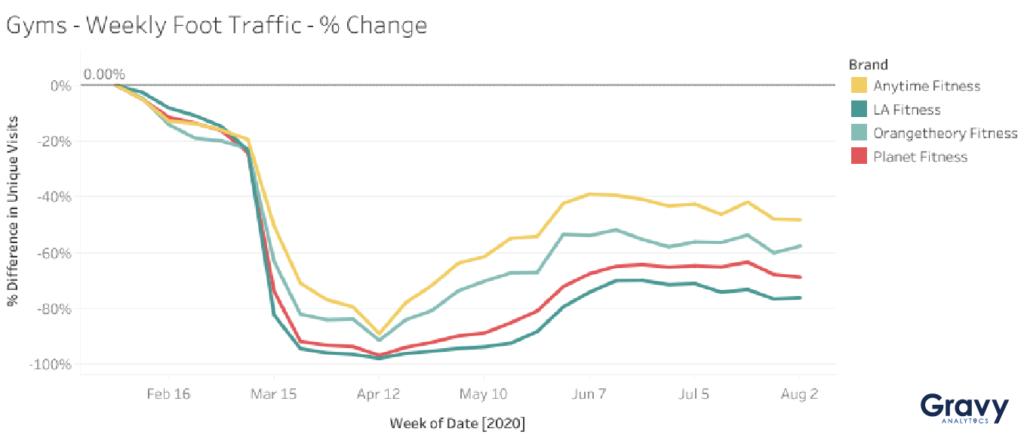

Anytime Fitness is Recovering Faster than Other Brands

Anytime Fitness, known for being open 24 hours a day, was slightly less impacted and has recovered foot traffic faster than LA Fitness, Orangetheory Fitness, and Planet Fitness. For the week of August 2, foot traffic at Anytime Fitness gyms was 48% lower, compared to the week of February 2. It is possible that gym goers like having access to a 24-hour gym so they can avoid going during peak hours. Orangetheory Fitness is right behind AnyTime Fitness in terms of recovery, possibly due to its set times for classes. While Planet Fitness leads in membership numbers, it has been one of the slowest to recover. LA Fitness has recovered most slowly; foot traffic to its gyms for the week of August 2 was still 76% lower compared to the week of February 2. LA Fitness has more of a luxury gym club atmosphere with extra amenities and classes, which could be one of the reasons why it has been especially slow to recover its foot traffic.

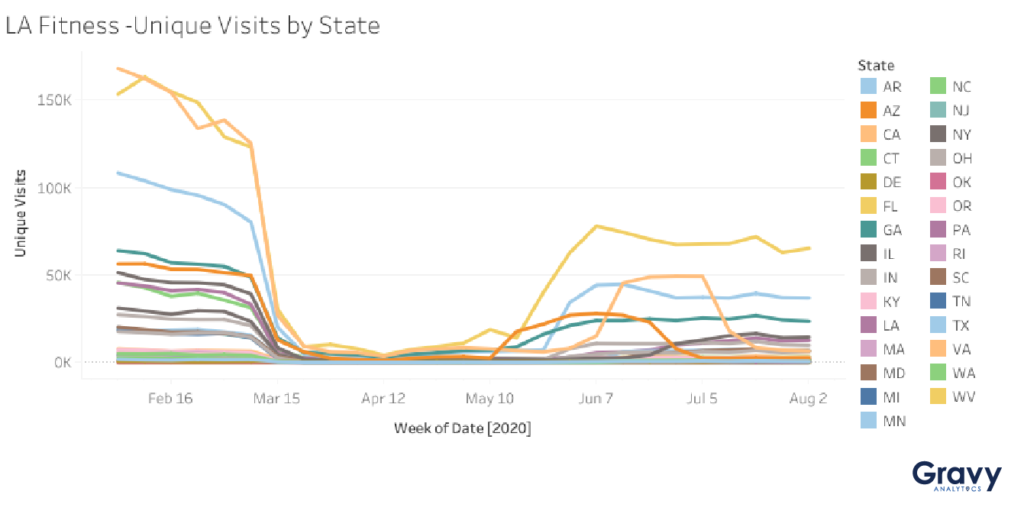

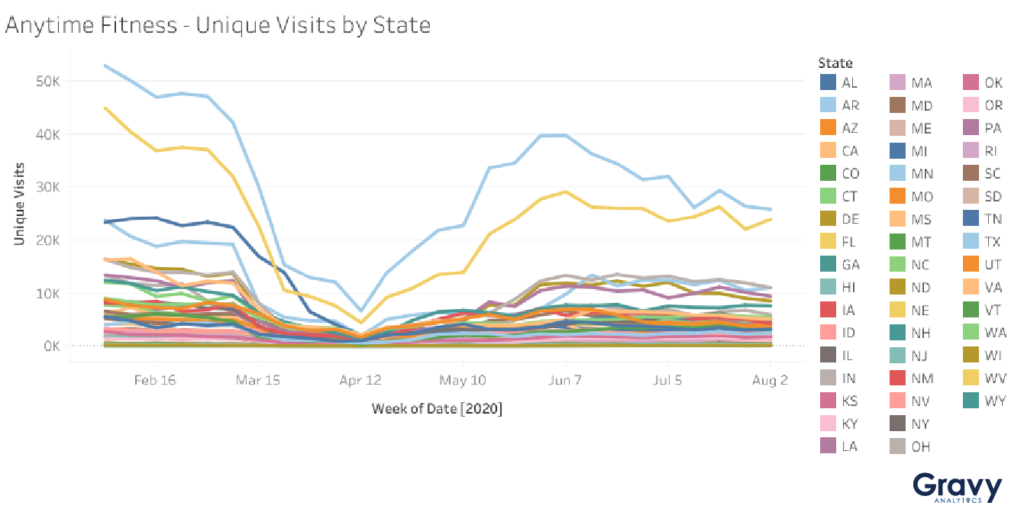

Regional Foot Traffic Trends for Anytime Fitness and LA Fitness

Before the pandemic started, LA Fitness saw most of its traffic at gyms in California, Florida, Texas, Georgia, and Arizona. In contrast, Anytime Fitness saw most of its pre-COVID foot traffic from Texas, Florida, Minnesota, Michigan, and Indiana. The geographic distribution of gym locations has also impacted brands’ ability to recover foot traffic. States like California and Arizona have been more affected by COVID-19 than states like Minnesota and Indiana.

What is the Future for Gyms?

According to our economic activity dashboard, September foot traffic to gyms remains 44% lower than pre-pandemic numbers (as of September 14, 2020). Based on this data, we predict that gym brands will continue to see less traffic throughout the remainder of 2020. The future of gyms in 2021 ultimately depends on whether consumers will decide to renew their memberships. With so many consumers relying on their at-home fitness equipment and exercise programs, it may be some time yet before foot traffic to gyms returns to pre-COVID levels.