Q4 2022 Consumer Trends Report: How is Foot Traffic to Car Dealerships Changing?

March 7, 2023

Between 2021 and 2022, many consumer trends have fluctuated greatly. As the 2020 pandemic becomes more distant, the sudden, overwhelming change in society has had lasting effects. As Americans continue navigating through a post-pandemic economy of soaring interest rates and insurance premiums, the auto industry is going through great disruption.

To learn more about how the auto industry is shifting, and where people are going within the industry, Gravy analyzed foot traffic to popular automotive destinations.

Q4 2022: Year-Over-Year Foot Traffic

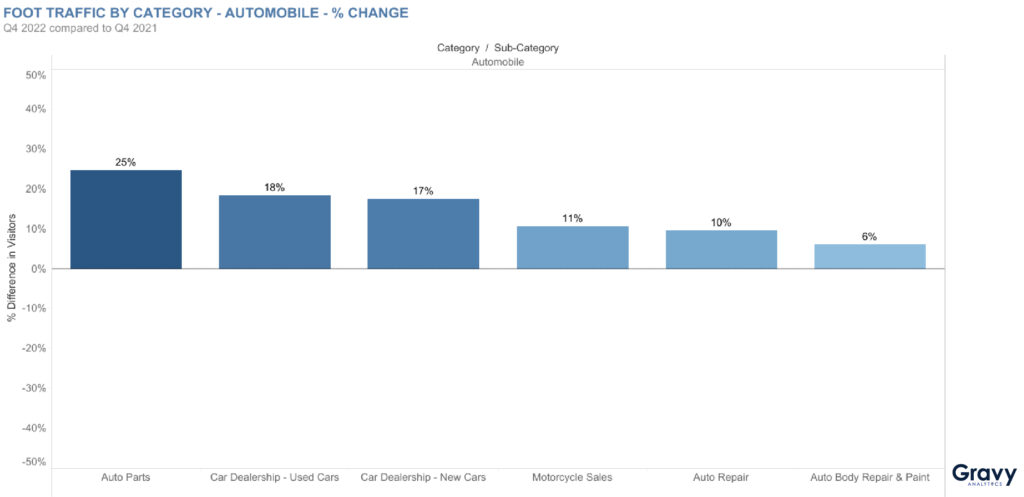

As seen in our recent Q4 2022 Consumer Trends Report, we compared foot traffic to automotive destinations from Q4 2021 to Q4 2022.

In this time period, both new and used car dealerships experienced similar growth in foot traffic. New car dealerships saw foot traffic that was 17% higher than the year prior, while used car dealerships saw an increase of 18% year-over-year. Although these were fairly high-performing categories, one category was the best performing: auto parts destinations. At a foot traffic increase of 25%, it seems more people may have chosen to repair their vehicles instead of upgrading.

At the end of Q4 2022, gas prices were going down, which could have led to more driving compared to earlier in the year. As more and more folks added wear and tear to their cars, perhaps they needed more repairs than they did in 2021. However, this doesn’t take away from the growth that dealerships saw. Although the cost of purchasing a car has been increasing over the last year, dealerships still experienced substantial growth in foot traffic. People are continuing to purchase vehicles, so where are people buying their cars?

What Does Foot Traffic to Car Dealerships Look Like?

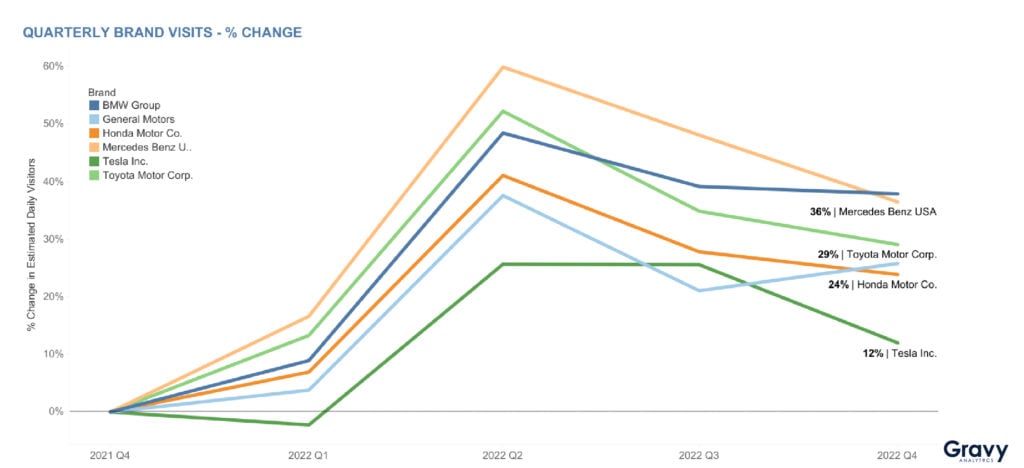

We analyzed the following dealerships for this time period: BMW, General Motors, Honda, Mercedes-Benz, Tesla, and Toyota. Of these, BMW dealerships saw the greatest growth in foot traffic, ending Q4 2022 with a 38% increase year-over-year. Also seeing significant growth, Mercedes-Benz ended Q4 2022 with a 36% increase in year-over-year foot traffic. Although Tesla saw the least foot traffic growth in this category, the company still experienced 12% more foot traffic to its showrooms compared to the year before.

Luxury auto brands experiencing such significant growth in foot traffic last year, despite market conditions. So, what can we learn when analyzing foot traffic to car dealerships and recent price hikes within the industry?

Rising Prices: Who’s Being Affected?

Even though Ford, Chevrolet, and Toyota were some of the most-purchased cars of 2022, luxury auto dealers saw the greatest increase in consumer visits last year, but why? Taking spots on 2022’s most-purchased luxury vehicles list, BMW and Mercedes-Benz were fairly popular in 2022. This popularity, and the increase in foot traffic luxury car locations saw, may be due to the shopping habits of in-market luxury car buyers.

Luxury car buyers tend to be passionate, meticulous consumers. Because they are 1.5 times more likely than the average car buyer to prioritize resale value and style, this audience tends to be strategic and thoughtful in the buying process. Luxury car buyers often do extensive research before making a purchase. Could the increased foot traffic to car dealerships be due to the frequency that these buyers stop by to check out cars, test drive, or negotiate deals?

In 2022, premium and super-premium car brands achieved record high sales, likely due to the cash saving many Americans did during the pandemic. However, amid the current landscape of high inflation and economic uncertainty, the increased demand for luxury cars may also indicate that the target market for high-end vehicles is less affected by inflation concerns. Whatever the case may be, it’s clear these dealerships are seeing soaring foot traffic and sales.

Car Dealerships in 2023

Although market conditions aren’t expected to improve quite yet, auto sales are predicted to continue improving. With inventory issues slowly resolving, fleet sales and selling incentives are likely to increase in 2023. This means foot traffic to new and used car dealerships will likely continue growing.

Used car dealerships may see more growth than new car dealerships as Americans grapple with high interest rates and other increasing costs of living. As these costs continue, car purchases grow more and more out of reach for many consumers. This means the used car market could take over the automotive category during 2023.

For more insight into current consumer trends across a variety of place categories and brands, download the full Q4 2022 Consumer Trends Report today.