ALDI and Lidl: Comparing Store Foot Traffic & Buyer Personas

June 3, 2021

Every region of the United States has its own favorite grocery store chains. Whether that’s Winn-Dixie and Publix in Florida, Harris Teeter in the Carolinas, or the organic phenomenon that is Whole Foods on a national level. In this post, we’re going to be zeroing in on Broadlands, Virginia, and its two darlings: ALDI and Lidl.

People love ALDI so much that there are social media groups who passionately post about their latest finds. What is it that draws people in? Maybe it’s the quirky food items that you can find there (Nutella stuffed cookies, anyone?), or perhaps it’s the option to buy gardening supplies and groceries. Whatever the reason, there’s no denying that the people who shop at ALDI, love it. They even have their own designated ALDI shopping cart quarters!

What about Lidl? At the mention of Lidl, a lot of people might automatically think of their impossibly low prices, or maybe their version of the ‘Aisle of Shame’. Much like ALDI, they too have their very own dedicated social media groups. A quick Google search has these two pinned against each other, with the first question being “which is less expensive, ALDI or Lidl?”

With these two chains being competitive, we thought it would be interesting to look at a Lidl and ALDI located next to each other in Broadlands, VA to see which one is performing the best. Who do you think has the most consumer visits? The results might surprise you!

ALDI vs. Lidl

Store Foot Traffic

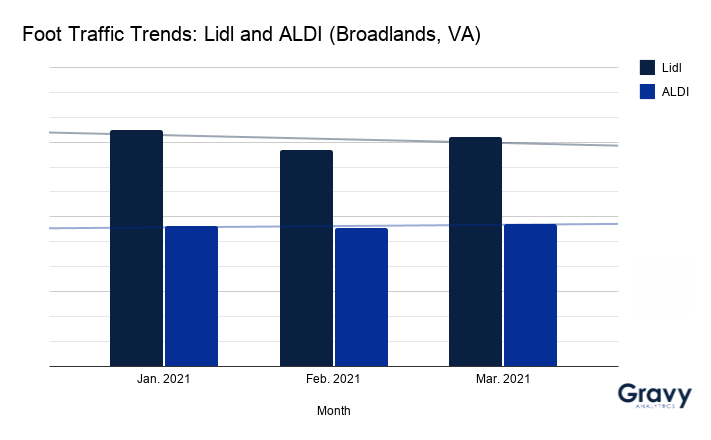

Let’s compare Q1 store foot traffic for the ALDI and Lidl in Broadlands, VA. For example, we see that in January 2021, Lidl’s foot traffic was nearly double what ALDI’s was. Both of them saw a slight decrease in February, but it seems like more consumers prefer shopping at Lidl over ALDI in this area.

The personas of shoppers at ALDI and Lidl also vary. Compared to the average Broadlands, VA resident, Lidl shoppers are more likely to be upscale travel enthusiasts, while ALDI shoppers are more likely to be artsy music fans with a pet at home.

Shopper Personas (March 2021)

ALDI and Lidl shoppers do have some overlapping consumer interests, but the stores fundamentally attract very different buyers. Both brands can use this information to refine their marketing messages and audience targeting, as well as to inform the selection of goods carried in local stores.

Why is Lidl Getting More Store Foot Traffic than ALDI?

It’s very likely that Lidl is playing the competitive game and making sure that their prices stay slightly lower than its competitor ALDI’s. Factors like store layout and inventory, as well as accessibility and roadside visibility, may also be coming into play. This may be the case in Broadlands since the stores are located across the street from one another, and consumers in the area are more often shopping at Lidl rather than ALDI.

Remember that Google search that we mentioned at the beginning of this piece? Well, the answer to the question of which store is less expensive, is Lidl. We are living at a time when people are not 100% secure with their finances and will often choose to shop at a less expensive location if it means that they get the same quality food.

Based on our data, we can predict that Lidl will continue to keep its lead over ALDI in Q2 2021.

Data Your Way with Gravy APIs

All of this data was generated using the Gravy Area Visitors and Area Personas APIs. These APIs allow consumer foot traffic trends to be analyzed and compared for any area. Brands can use store foot traffic data for predictive analytics, analyze visitor traffic to competitor locations, and attribute foot traffic resulting from exposure to advertising campaigns.

The Area Personas API can give you insight into current market trends and provide in-depth insight into who is shopping with you and why.

Gravy’s APIs provide ready access to consumer data that can take your next campaign above and beyond. We believe that brands should be able to access data their way. This means that you only access and pay for the data that you need when you need it. Get insights into who your biggest brand loyalists are, what they are interested in, and when they prefer to shop with you. For more information on Gravy’s Area Visitors API or Area Personas API, speak with an expert today.