What Foot Traffic to Chipotle Reveals about Consumer Interest in Fast-Casual Restaurants in 2023

April 18, 2023

Recent consumer foot traffic trends suggest a growing emphasis on affordability and convenience, particularly with respect to food and dining options. Toward the end of 2022, consumers seemed to be focusing on convenient and affordable grocery options and choosing to visit fast food restaurants over any other type of restaurant. So, now that the holidays are over and 2023 is in full swing, are consumer foot traffic trends looking any different? To better understand the ways in which consumer preferences may be shifting, Gravy analyzed consumer foot traffic to fast-casual restaurants like Chipotle Mexican Grill and some of its competitors.

How has consumer foot traffic to top fast-casual restaurants changed year-over-year? What might these changes mean for the food and beverage industry for the rest of 2023?

Foot Traffic to Fast-Casual Restaurants Over the Last Year

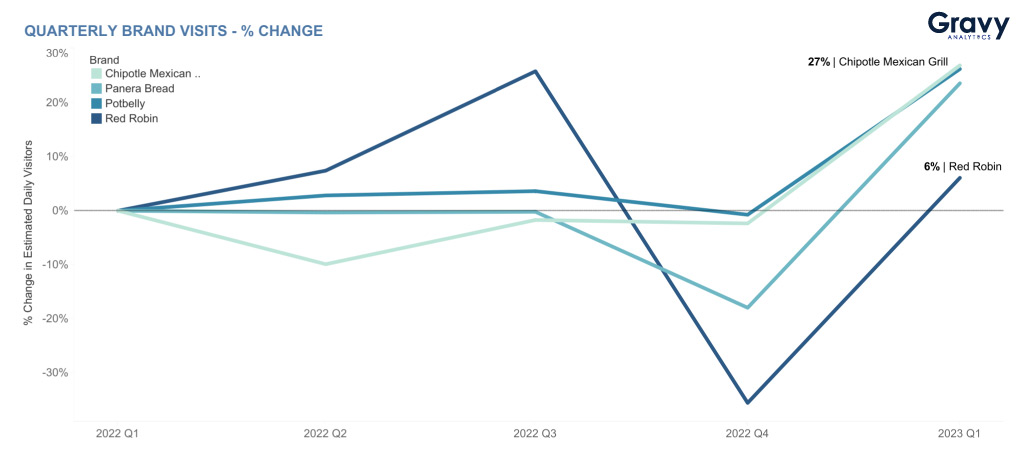

We analyzed consumer foot traffic to Chipotle locations along with Panera Bread, Potbelly, and Red Robin from Q1 2022 to Q1 2023. Chipotle saw a year-over-year foot traffic increase of 27%, while Potbelly and Panera Bread saw increases of 26% and 24%, respectively, over the same time period. In contrast to these relatively significant increases, Red Robin experienced a 6% increase in year-over-year foot traffic. Red Robin also followed a distinct foot traffic pattern over the last year, seeing a sharp increase in Q3 2022, followed by a steep decrease in Q4 2022. In contrast, Chipotle, Potbelly, and Panera Bread all followed similar, fairly level foot traffic patterns over the last year.

Red Robin’s distinctive foot traffic pattern may be due to its nature of being a sit-down restaurant, albeit a casual one. Sit-down restaurants are often considered less convenient and more pricey than fast-casual restaurant designs. Because sit-down restaurants have largely been seeing declines in year-over-year foot traffic, perhaps Red Robin’s sit-down atmosphere has contributed to its less predictable foot traffic pattern when compared to the other three fast-casual chains.

All four restaurants experienced foot traffic declines in Q4 of last year, likely due to holiday spending habits which usually emphasize allocating money for gifts, travel, or other large purchases as the year comes to a close. However, in Q1 2023, all four restaurants saw notable rebounds in foot traffic. So, why are fast-casual restaurants now seeing significant increases in year-over-year foot traffic?

2023’s Newest Trend in Dining

2022 was the year of post-pandemic economic disruptions, such as the historic spike in inflation rates, and many consumer foot traffic trends reflected that. For example, consumers were largely choosing the most affordable dining options, choosing discount or dollar stores for shopping, and visiting home improvement stores like Lowe’s, suggesting a shift toward home repair over home buying. The big picture shows that consumers could be worried about the economy, trying to stretch their dollars with one-stop shopping and quick, cheap bites.

During the holiday season in 2022, consumers likely prioritized holiday gift purchases over dining out. After the holidays and into Q1 2023, many consumers may have started spending more freely following the end of the busy gift-buying season. After all, foot traffic to fast-casual restaurants was on an increase in Q3 of last year, before the holiday season. So, perhaps foot traffic to places like Chipotle is returning as more and more people reintroduce restaurants into their regular routines.

Furthermore, Americans are still concerned about the state of the economy, and many Americans say their financial situations have not improved since last year. So although foot traffic to Chipotle and its competitors is increasing, will it continue to grow this year or will economic concerns like inflation and widespread layoffs become obstacles?

Foot Traffic to Chipotle in 2023

In 2023, we will likely continue to see an emphasis on loyalty and rewards programs. As customers look for the best value and the smoothest experience, loyalty programs could be key in attracting more visitors. Chipotle has a thorough rewards program and started 2023 off by offering a new set of perks for loyal customers. As Chipotle and other fast-casual restaurants continue developing their rewards programs and offerings, consumers will likely continue visiting in hopes of receiving more perks as they spend.

Not only is Chipotle in touch with current consumer needs by improving on its rewards program, but Chipotle may have an advantage due to its particular audience. Chipotle’s menu appeals to a high-earning customer base. In fact, the average Chipotle customer has a college degree and makes over $80,000 a year. This is likely why Chipotle has been able to increase menu prices as food costs soar, while maintaining a healthy profit margin. Their customers are fairly financially stable and haven’t been significantly swayed by menu price hikes.

Chipotle’s college-educated, millennial customer base is also joined by an overrepresentation of Gen Z consumers, who have an immense spending power in the U.S. From the looks of Chipotle’s average customer base and increasing foot traffic, the company may be in the perfect position to continue growing amid economic challenges. Furthermore, Chipotle’s plans for future growth include an innovative and sustainable restaurant design, which could attract more consumers with eco-friendly values.

As post-pandemic economic disruptions continue on, and Chipotle continues as a leader in the fast-casual restaurant space, it is obvious that economic concerns are not the only driver for consumerism. Chipotle is an example of a well-rounded company that can withstand challenges while continuing to grow, appealing to customers for a variety of reasons. It will be interesting to see how foot traffic to Chipotle evolves in 2023, and if Chipotle and other fast-casual restaurants will continue on the rise.

For more brand performance analyses like this, subscribe to our email newsletter today.