Foot Traffic to McDonald’s: What Recent Trends Mean for the Company and Its Competitors

January 24, 2023

Over the last few years, there have been significant changes in the way people move around in the U.S. During the pandemic, many Americans began working from home, while others also chose to relocate. In the midst of these major changes, Americans have also been grappling with a steep rise in inflation and economic uncertainty. The chaos surrounding the pandemic has affected foot traffic to even the most popular brands’ locations.

Dining, shopping, and entertainment destinations have all seen major fluctuations in foot traffic since 2020. How has foot traffic to top fast food restaurants been impacted? How have consumer visits shifted compared to last year and how could this change in 2023? To find out, we took a look at consumer foot traffic to McDonald’s and other top fast food chains.

Analysis: Foot Traffic to McDonald’s and Competitor Locations

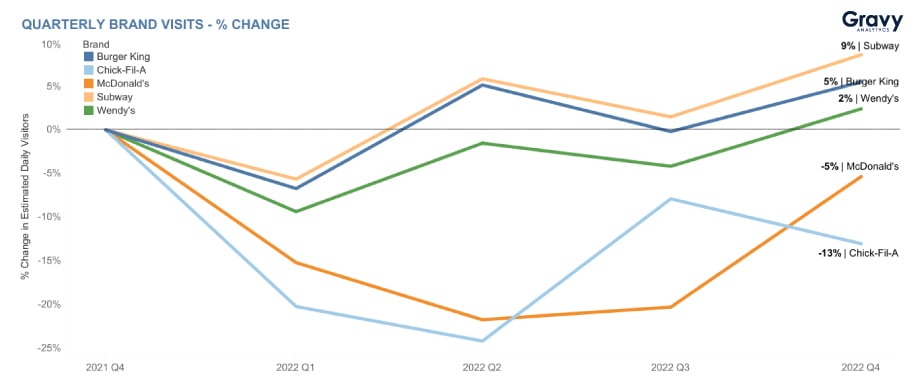

We analyzed the patterns of recent consumer foot traffic to McDonald’s, Chick-fil-A, Wendy’s, Burger King, and Subway. These companies are all major players in the quick service restaurant (QSR) market. From Q4 2021 to Q4 2022, McDonald’s experienced a decline in year-over-year foot traffic that ended with a -5% change. Chick-fil-A was the only other company in our analysis that ended Q4 2022 with a negative change in foot traffic at -13% year-over-year. Although there was a drop in foot traffic across the board in Q1 2022, the other three companies—Wendy’s, Burger King, and Subway—recovered by Q2 2022.

By Q4 2022, Wendy’s, Burger King, and Subway saw year-over-year increases of 2%, 5%, and 9%, respectively. McDonald’s and Chick-fil-A continued seeing negative year-over-year foot traffic rates for the rest of the year as their competitors maintained and increased the percentage of in-person visits.

Wendy’s, Burger King, and Subway all followed near-identical patterns in foot traffic last year. Interestingly, Chick-fil-A followed an opposite trend in foot traffic to the three. As McDonald’s slowly saw foot traffic increase throughout the year, Chick-fil-A appeared to see decreases when Wendy’s, Burger King, and Subway saw increases. This could indicate that marketing efforts by competing fast food chains may have been successful in attracting Chick-fil-A customers. The recent drive-through fatigue we saw in Q3 2022 could be coming to an end, and fast casual diners could be trickling back into fast food restaurants. So, what might be driving the apparent interest in certain fast food restaurants over others?

Does Foot Traffic Equal Loyalty?

Wendy’s, Burger King, and Subway are some of the nation’s most popular fast food restaurants, and according to their foot traffic increases year-over-year, the three chains are doing the best at retaining and attracting customers. This may be because all three chains are in the midst of growth initiatives. For example, Burger King’s plan to catch up to its competitors includes a $400 million budget to improve internal operations and digital marketing. Wendy’s also has plans to improve through strategic franchising and non-traditional development, along with Subway continuing to capitalize on its successful menu refresh.

These three companies’ strategic initiatives have proven successful as they’ve resulted in increased sales and customer foot traffic. So, if Americans are choosing to visit these three chains the most, they must be more committed and loyal to these brands, right?

Although it seems consumer sentiment is on the side of Wendy’s, Burger King, and Subway based on their foot traffic, McDonald’s and Chick-fil-A are still considered to be the leaders in fast food. As QSR market leaders, McDonald’s and Chick-fil-A likely attract some of the most loyal, fast-food loving customers. These customers usually share a common priority: convenience. Because convenience now has a new face, namely third-party delivery services, many loyal McDonald’s and Chick-fil-A customers could be turning to services like DoorDash or Grubhub in lieu of driving through or dining in. In fact, it’s safe to say these two chains are top performers for delivery services as foods like french fries, chicken nuggets, and burgers are the most popular to order.

It’s clear that although foot traffic to McDonald’s locations declined year-over-year, consumers’ affinity for the fast food giant remains strong—and it’ll likely increase in 2023.

Convenience vs. Price

While Wendy’s, Burger King, and Subway have seen a rise in consumer foot traffic year-over-year, McDonald’s continues to dominate the overall QSR market. Why is that? Although McDonald’s has strong competition, when considering its pricing, McDonald’s is in a favorable position. This is especially important because a major reason consumers are drawn to fast food is because of the affordable prices. Quick food at a cheap price was revolutionary when QSR was born, but how has inflation impacted America’s beloved menus today?

McDonald’s is one of the only fast food chains to decrease menu prices in 2022. Its menu prices dropped by 5% over the last year. On the other hand, Burger King had menu increases, boasting the priciest fast food item out there: chicken fries. On top of that, Wendy’s officially became the most expensive fast food chain, with Chick-fil-A greatly inflating prices as well. With the post-pandemic uncertainty many are feeling in regard to finances, fast food price hikes will likely drive Americans away from costly menus and added delivery fees. This means foot traffic to McDonald’s locations could continue increasing throughout 2023. It will be interesting to see how competing QSR brands adapt to a more competitive landscape as more consumers look to stretch their budgets further.

For more information on how location intelligence and foot traffic data can benefit your business, connect with an expert from Gravy Analytics today.