Post-Pandemic Foot Traffic Analysis: What Can Best Buy’s Foot Traffic Tell Us About Consumer Interest?

January 17, 2023

Consumer electronics may be losing their charm in 2023. Due to post-pandemic economic instability, unemployment, and inflation, high-price items are sitting on the back burner for many Americans. Electronic goods are often frivolous, luxury, or entertainment-focused buys, so has consumer foot traffic swayed away from top destinations like Best Buy?

To better understand consumer attitudes toward pricey gadgets, Gravy analyzed foot traffic to four top consumer electronics destinations: Walmart, Best Buy, Target, and Apple Store. With the heightened popularity of dollar and discount stores, and an increase in theft for even simple items like toiletries, are consumers still prioritizing buying electronics for fun? According to Best Buy’s foot traffic, along with current consumer behavior, the future for electronics destinations looks bleak.

Best Buy’s Foot Traffic Nosedive

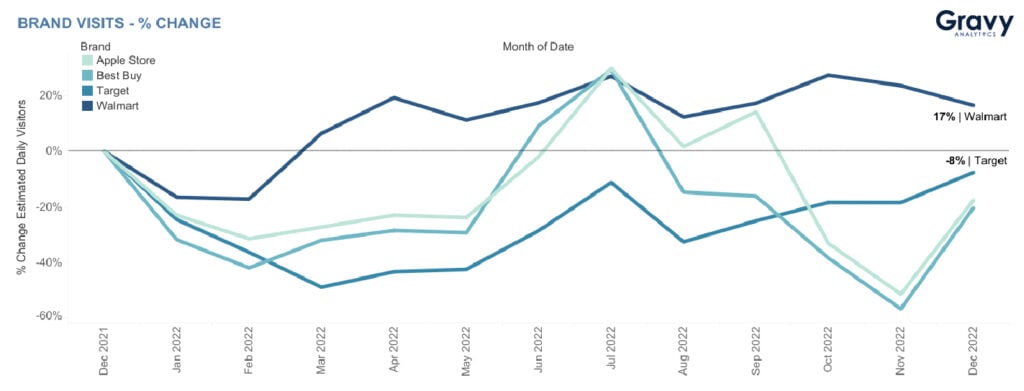

We analyzed foot traffic to these chain stores from December 2021 to December 2022. Overall, Walmart and Target saw similar patterns in foot traffic, while Best Buy and Apple Store followed a different path. Best Buy experienced the most abrupt changes in foot traffic over the last year. At the end of December 2022, Best Buy saw a -20% change in foot traffic year-over-year—the largest drop of the brands we analyzed.

Apple Store is the only other chain in our analysis focused on electronics. They also saw a significant drop in foot traffic: -18% year-over-year. While Best Buy and Apple Store both saw the steepest foot traffic declines, they both followed a very similar pattern of ups and downs throughout the year. During July 2022, while there was a spike in foot traffic across the board, there was a fairly dramatic spike for Best Buy and Apple Store. At that time, Best Buy foot traffic and Apple Store foot traffic were at their highest, followed by a swift decrease back into the negatives.

In contrast, Target and Walmart both ended 2022 with a higher percentage of foot traffic than Best Buy or Apple Store. Target ended December 2022 with a -8% change year-over-year, and Walmart saw a 17% increase for the same time period. Both big-box chains experienced the lowest foot traffic during early 2022. Since then, in-person visits have been on a steady incline with small spikes throughout the year for both. So, what does this tell us in regard to consumer behavior in 2022 and into the new year?

General Merchandise vs. Specialty Stores

Best Buy and Apple Store are specialty stores, meaning they carry a specific category of retail items. In this case, that category is consumer and luxury electronic goods. Conversely, Walmart and Target also carry a variety of electronics, but they are general merchandise stores. Since they carry a wide range of general products, these chain stores attract a wider variety of audiences. This could be why foot traffic to Target and Walmart appeared to be more steady than Best Buy or Apple Store, with only slight shifts throughout 2022.

According to our recent analyses of consumer behavior, visitors are seeking out value items and good deals, which often exclude pricey electronics. Consumers have also been itching to socialize outside of the home post-pandemic. Due to the sharp rise in inflation seen in 2022, shopping and dining at reasonable prices became a popular social activity last year. This may explain why there is an apparent decrease in consumer interest in electronic goods.

Apple Store and Best Buy foot traffic numbers have been volatile since the end of 2021. The ebbs and flows of Best Buy and Apple Store have been more dramatic than their general merchandise counterparts. Their foot traffic reflects the tense, post-pandemic economic state. As consumers continue to prioritize affordable necessities, there may be continued dips in foot traffic for the two chains.

The Big Picture

For both our specialty and general merchandise chains, there were some similarities. During July 2022, when there was a spike in foot traffic for all four brands, back-to-school season was in full swing. Back-to-school season is often busy for retailers, and because electronics are becoming more and more utilized in academia, Best Buy and Apple Store may have seen an influx in students at that time. Best Buy also held a large “Black Friday in July” sale, and the other three brands likely offered specials of their own for the back-to-school season.

Later in the year, Target, Apple Store, and Best Buy foot traffic patterns sloped upward during the holiday season. This is likely due to holiday shopping and sales that take over November and December every year. Walmart was the only chain store to experience a slight decline in foot traffic during the holidays. As Walmart’s popularity increased over 2022, consumers likely chose competing stores for a more diverse pick of gift items. Despite this holiday uptick, Apple Store and Best Buy ended 2022 with considerably lower foot traffic year-over-year, and this could continue during 2023.

Consumer Electronics: What’s Next?

It’s no secret that specialty electronic stores have been struggling to attract shoppers lately as consumers seek the most affordable products. Not only that, but consumers are also doing rather than buying. Recent trends show Americans going outside of the home for post-pandemic entertainment more and more. This means the once-high demand for electronic entertainment has subsided, leaving specialty chain stores like Best Buy to deal with a quick decline in sales and foot traffic.

As the year progresses, consumers will likely continue to hold out on buying electronic goods for the next best deal. This means Apple Store and Best Buy may continue seeing inconsistent foot traffic. This inconsistency could lead to more store closures, lay offs, and dramatic price markdowns as a result. We predict consumer electronics destinations will continue seeing only blips in foot traffic throughout 2023 as consumers focus on mindful spending and social activity.

For more on how your business can utilize location intelligence to gain foot traffic insights like these, connect with a Gravy expert today.